Basics of the Stock Market: A Beginner’s Guide.

The stock market is one of the most powerful tools for wealth creation. Many people hear about it but don’t fully understand how it works. If you’re new to investing, this guide will help you understand the basics of the stock market, how it helps in making money, and how to choose the best stocks.

—

What is the Stock Market?

The stock market is a marketplace where people buy and sell shares of publicly traded companies. It operates like any other market, but instead of buying goods, investors buy small ownership pieces of companies.

Stock markets are regulated exchanges where buyers and sellers trade stocks. The most well-known stock exchanges are:

New York Stock Exchange (NYSE) – USA

Nasdaq – USA

National Stock Exchange (NSE) – India

Bombay Stock Exchange (BSE) – India

Stock prices fluctuate based on supply and demand, company performance, and market trends.

—

What is a Share?

A share (or stock) represents a unit of ownership in a company. When you buy a company’s stock, you become a shareholder, which means you own a small part of that company.

Types of Shares:

1. Common Shares – These give voting rights and dividends but come with higher risk.

2. Preferred Shares – These give priority in dividend payments but usually don’t have voting rights.

The value of shares can go up or down depending on the company’s performance, economic conditions, and market sentiment.

—

How Does the Stock Market Help You Make Money?

Investing in the stock market allows you to grow your wealth over time in two main ways:

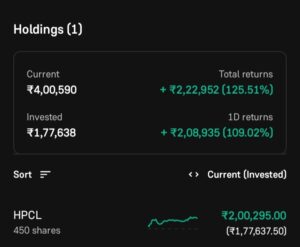

1. Capital Appreciation (Stock Price Increases)

If you buy a stock at ₹ 100 and its price rises to ₹ 50 ,you make a profit of ₹ 50 per share when you sell. This is called capital appreciation.

2. Dividends (Regular Income from Stocks)

Many companies share a portion of their profits with investors through dividends. If a company pays ₹. 5 per share as a dividend and you own 100 shares, you receive ₹ 500 in dividends.

3. Long-Term Wealth Creation.

Historically, stock markets have provided higher returns compared to fixed deposits, real estate, or gold in the long run.

—

How Can You Invest in the Stock Market?

To invest in the stock market, follow these steps:

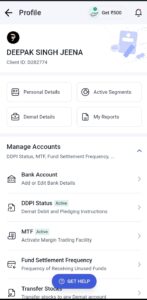

1. Open a Demat & Trading Account

A Demat account holds your shares, while a trading account allows you to buy and sell stocks. You can open these with stockbrokers like Zerodha, Upstox, or Angel One.

2. Fund Your Trading Account

Deposit money into your trading account to start investing.

3. Research and Choose Stocks

Study the company’s financials, growth potential, and past performance before investing.

4. Start Investing

Buy stocks through your broker’s trading platform. You can start with as little as ₹. 500.

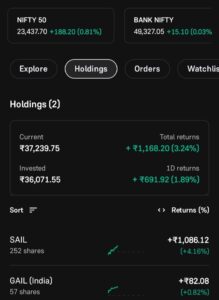

5. Monitor Your Investments

Keep track of your stocks, company performance, and market trends.

—

How to Choose the Best Stocks for Investment?

Selecting the right stocks is important for making profits. Here’s how you can pick the best stocks:

1. Look for Fundamentally Strong Companies

Check for:

Revenue Growth – Is the company’s sales increasing year after year?

Profitability – Is the company making consistent profits?

Debt Levels – Avoid companies with too much debt.

2. Understand the Business Model

Invest in companies whose business you understand. For example, if you use a company’s products or services daily (like Reliance, HDFC Bank, or Tata), you may feel more confident investing in them.

3. Analyze Past Performance

Check the stock’s 5-year or 10-year growth to see if it has given stable returns.

4. Compare with Competitors

Compare a company’s performance with similar companies in the industry.

5. Diversify Your Portfolio

Don’t put all your money in one stock. Invest in different industries to reduce risk.

—

Final Thoughts

Investing in the stock market can help you grow your wealth, but it requires patience and research. Start small, learn continuously, and invest wisely. Over time, with the right strategy, you can build a strong portfolio that provides long-term financial growth.